‘Things are going to break’: Kevin O’Leary predicts Fed hikes will lead to more U.S. regional bank failures PUBLISHED THU, JUL 27 20236:13 AM EDTUPDATED 27 MIN AGO

“Shark Tank” investor Kevin O’Leary predicts the ongoing cycle of U.S. Federal Reserve rate hikes could lead to more regional U.S. bank failures.

Fed Chair Jerome Powell said the central bank is not yet fully confident that inflation is defeated even though recent headline reads show that price increases have cooled significantly.

RELATED INVESTING NEWS

The consumer price index rose 3% from a year ago in June — the lowest level since March 2021. But Powell said the Fed would need to “hold policy at a restrictive level for some time” and be prepared to raise rates further, given that core inflation is still above 3% — higher than its 2% annual target.

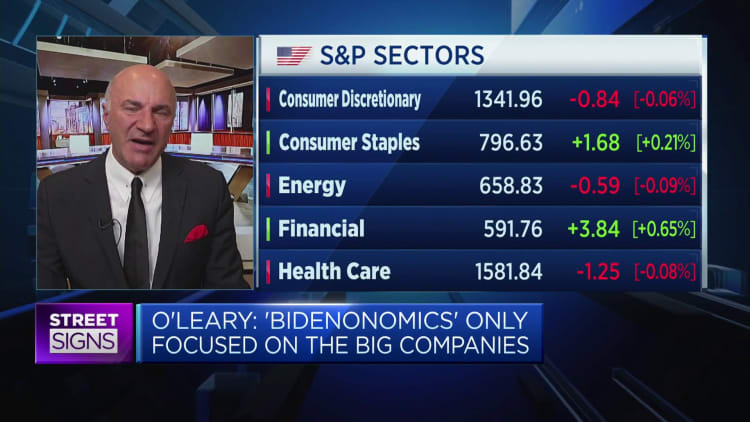

“You keep squeezing the toothpaste tube, you keep rolling it up, you keep raising rates, and you know things are going to break, you just don’t know when and where,” O’Leary, who runs his own early stage venture capital firm, O’Leary Ventures, told CNBC’s “Street Signs Asia” early Thursday after the Fed’s latest rate hike announcement.

“I am just predicting — and I am very cautious on this — it will break down in the regional banks, which supports 60% of the economy,” he said, adding that the rapid rise in the cost of capital is “killing them on their real estate loans.”

Regional banks such as First Republic, Silicon Valley Bank and Signature Bank have folded since March.

Those institutions were destabilized by a monetary tightening cycle that has seen 11 rate hikes since March 2022, and the latest increase takes benchmark borrowing costs to their highest level in more than 22 years.

“I am telling investors that I work with and I advise ... let’s wait 90 days to see what happens in the small banking arena in the United States,” O’Leary said.

He also warned that the Fed could raise rates to beyond its current projections.

“Terminal rate, where the Fed stops, could be 6.25, could be 6.50,” O’Leary said. “So you’ve really got to think about this if you think about the long term and the short-term effect.”

That’s higher than the Fed’s median end-2023 forecast for its funds rate, which stands at 5.6% as of the June meeting. It is also higher than the most hawkish prediction of 6.1%, according to the Fed’s latest summary of economic projections issued in June.

“We’ve started to see the cracks, the Titanic has not [sunk],” O’Leary said.

Disclosure: CNBC owns the exclusive off-network cable rights to “Shark Tank.”

Nhận xét

Đăng nhận xét